02 Dec New financial reporting requirements for Significant Global Entities are now law

Financial reporting requirements for Significant Global Entities

On 3 December 2015, the Senate amended laws to require ‘Significant Global Entities’ to lodge a general purpose financial statement with the Australian Tax Office if they do not already lodge one with the Australian Securities and Investments Commission (ASIC).

The ATO is currently formulating administrative arrangements for the new law following its release of a consultation paper in August 2016.

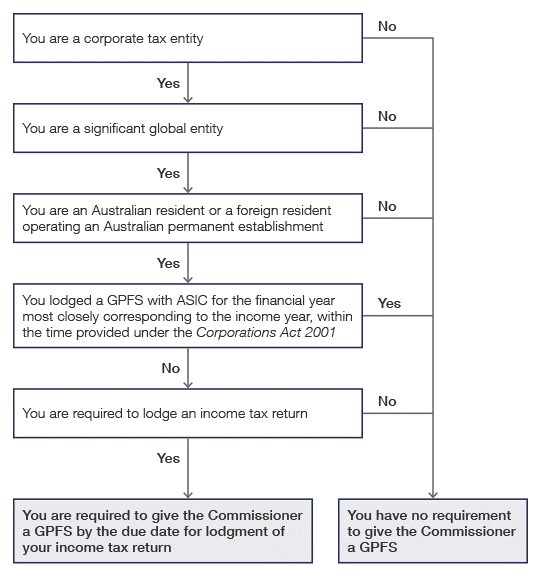

See below to find out which entities are affected and what this means for multinationals in Australia.

On 3 December 2015, the Senate amended laws to require ‘Significant Global Entities’ to lodge a general purpose financial statement with the Australian Tax Office if they do not already lodge one with the Australian Securities and Investments Commission (ASIC).

What does this mean for multi-nationals in Australia?

Under these new legislative initiatives dubbed ‘Combating Multinational Tax Avoidance’, many multi-national companies will be obliged to lodge financial reports for the first time. Others may need to change the format of their reports from ‘special purpose’ to ‘general purpose’. Because these reports will require prior year comparatives, we recommend that those affected by these changes begin preparing now.

Will this amendment affect your company?

Your company will be classed as a ‘Significant Global Entity’ (SGE) and affected by the new law if it is:

- A global parent entity with an annual global income of A$1 billion or more, or

- A member of a group of entities consolidated for accounting purposes and one of the other group members is a global parent entity with an annual global income of A$1 billion or more.

The legislation may also apply to some entities currently exempt from reporting requirements under the Corporations Act (ASIC CO 98/98 & 98/1418). These include:

- Subsidiaries of foreign groups controlled by a foreign company but not part of a large group

- Australian branches of foreign companies that do not currently prepare branch accounts

- Other entities such as partnerships and trusts that meet the definition of an SGE

Note that wholly-owned subsidiaries may only be able to rely on relief if their parent company lodges a General Purpose Financial Statement with ASIC.

When is the first income year where the new law applies?

The amendment applies to income years commencing 1 July 2016 or the entity’s financial year that most closely corresponds to that income year. For example, if an entity’s financial year end falls on 31 March for both tax and accounting purposes, the new requirement will first apply to the financial year commencing on 1 April 2017.

However, because the prior year’s comparative financial information also needs to be included, this means that two years of financial figures will be required in the General Purpose Financial Report, ie for the year ending 31 March 2016 as well as for the year ending 31 March 2017 in the above example.

In order to be implemented effectively, there will be a need to address a number of technical and financial reporting issues. The Australian Taxation Office is planning to commence consultation with stakeholders in an effort to minimise compliance costs for affected entities.

Please contact the author, Steven Zabeti, regarding any areas of the new law that your organisation finds ‘unclear’ or envisages difficulty implementing, or if you would like further information on how you can respond.